Getting a mortgage can be stressful and confusing; it doesn't have to be, let us show you how

Getting a mortgage can be stressful and confusing;

it doesn't have to be, let us show you how

About Us

The power of working with Flawless Financing at The Collective Mortgage Group is that you don’t just get a mortgage broker, you get the care and attention of our entire experienced mortgage team.

We provide mortgage services to loyal clients in a supportive and transparent environment, with an authentic voice, helping them feel protected, while saving time and money. Our goal is to take away some of the stress and confusion, and provide clients with the peace, confidence and understanding to be able to make informed decisions.

It is an honour to be a part of a clients homeownership journey, and we always feel incredibly fortunate to help make it a positive experience.

About Us

The power of working with Flawless Financing is that you don’t just get a mortgage broker, you get the care and attention of our entire experienced mortgage team.

We provide mortgage services to loyal clients in a supportive and transparent environment, with an authentic voice, helping them feel protected, while saving time and money. Our goal is to take away some of the stress and confusion, and provide clients with the peace, confidence and understanding to be able to make informed decisions.

It is an honour to be a part of a clients homeownership journey, and we always feel incredibly fortunate to help make it a positive experience.

About Us

The power of working with Flawless Financing is that you don’t just get a mortgage broker, you get the care and attention of our entire experienced mortgage team.

We provide mortgage services to loyal clients in a supportive and transparent environment, with an authentic voice, helping them feel protected, while saving time and money. Our goal is to take away some of the stress and confusion, and provide clients with the peace, confidence and understanding to be able to make informed decisions.

It is an honour to be a part of a clients homeownership journey, and we always feel incredibly fortunate to help make it a positive experience.

We have the knowledge, experience and resources to help you, no matter your mortgage needs!

Experienced Home Buyers

If you're looking to; climb the property ladder, refinance, or renew your existing mortgage, let us help you arrange financing so you can get the best mortgage for you!

Mortgage into Retirement

Senior Canadians are looking for options. Although a great product for some people, the reverse mortgage isn't your only option into retirement. Let's discuss ALL your options, instead of making assumptions.

First Time Home Buyers

If you're looking to buy your first home, we've got the advice (and expertise) you're looking for. Let our team of professionals guide you through the home buying process.

Going Through a Separation?

No judgements, life happens. If you're going through a divorce or separation, there are programs that might allow you to keep the matrimonial home. Make sure to contact us for more information!

Construction Mortgage

Always wanted to build your dream home? Nothing on the market that peaks your interest? We won't pick up a hammer, but we'd love to help build your dream.

Rental Property

Investment properties can be a great idea, but they come with a bit of extra homework. Let's be study buddies and work together to make sure this major investment of yours makes sense.

We have the knowledge, experience and resources to help you, no matter your mortgage needs!

First Time Home Buyers

If you're looking to buy your first home, we've got the information (and expertise) you're looking for. Let our team of professionals guide you through the home buying process.

Experienced Home Buyers

If you're looking to; climb the property ladder, refinance, or renew your existing mortgage, let us help you arrange financing so you can get the best mortgage for you!

Mortgage into Retirement

Senior Canadians are looking for options. Although a great product for some people, the reverse mortgage isn't your only option into retirement. Let's discuss ALL your options, instead of making assumptions.

Going Through a Separation?

No judgements, life happens. If you're going through a divorce or separation, there are programs that might allow you to keep the matrimonial home. Make sure to contact us for more information!

Rental Property

Investment properties can be a great idea, but they come with a bit of extra homework. Let's be study buddies and work together to make sure this major investment of yours makes sense.

Construction Mortgage

Always wanted to build your dream home? Nothing on the market that peaks your interest? We won't pick up a hammer, but we'd love to help build your dream.

We have the knowledge, experience and resources to help you, no matter your mortgage needs!

Experienced Home Buyers

If you're looking to; climb the property ladder, refinance, or renew your existing mortgage, let us help you arrange financing so you can get the best mortgage for you!

First Time Home Buyers

If you're looking to buy your first home, we've got the information (and expertise) you're looking for. Let our team of professionals guide you through the home buying process.

Rental Property

Investment properties can be a great idea, but they come with a bit of extra homework. Let's be study buddies and work together to make sure this major investment of yours makes sense.

Mortgage into Retirement

Senior Canadians are looking for options. Although a great product for some people, the payment-optional (reverse) mortgage isn't your only option into retirement. Let's discuss ALL your options, instead of making assumptions.

Going Through a Separation?

No judgements, life happens. If you're going through a divorce or separation, there are programs that might allow you to keep the matrimonial home. Make sure to contact us for more information!

Construction Mortgage

Always wanted to build your dream home? Nothing on the market that peaks your interest? We won't pick up a hammer, but we'd love to help build your dream.

Our Process Walkthrough

Here are the steps that we'll go through together to get you to your end goal.

Please remember that due to every individual situation being different, the stages and the order may vary.

Initial Chat

How can we help you?

This is where we can get a sense of your current situation, what solutions may be available to you, and what your end goal is. We want to start off with clarity so that we can reach your dreams as efficiently as possible.

This is also where we’ll gather information about your team of professionals (financial planner, accountant, lawyer/notary). If you don’t have a fully established team, we can help you build one with professionals we trust to be a good fit.

Fill Out Application

Tell us about yourself

After we have an understanding of your goals, we will invite you to fill out a thorough application via our secure online portal. This application will cover your personal information, living history, income, assets, and liabilities.

Submit Documents

Help us help you

Once you've submitted your application, a list of requested documents will be automatically generated based on your information. You can confidently upload your document to our secure portal. This is a crucial stage in the process to ensure we're armed with the right information to find you the best possible mortgage solution.

We can help you streamline your document collection process by reaching out to your accountant and/or financial advisor.

Approval

Let's put your plan into action!

If you're house hunting, we will provide you and your REALTOR® with a pre-approval letter to strengthen your offers.

Otherwise, at this stage you will receive a breakdown of your conditional commitment suitable for your situation (e.g. refinance, equity take out, transfer, renewal), which we will discuss together in detail.

Mortgage Complete

Streamers, balloons and keys.... oh my!

Once all conditions of your commitment have been satisfied, your solicitor will help to finalize your goal.

Our role doesn’t end here! We will be in touch annually to ensure you are on track with your goals. Expect regular updates and announcements from us as well. We want to ensure you’re kept in the loop with any changes that could impact you and your family. Have questions in the meantime? We are always free for a call or email.

How can we help you?

This is where we can get a sense of your current situation, what solutions may be available to you, and what your end goal is. We want to start off with clarity so that we can reach your dreams as efficiently as possible.

This is also where we’ll gather information about your team of professionals (financial planner, accountant, lawyer/notary). If you don’t have a fully established team, we can help you build one with professionals we trust to be a good fit.

Tell us about yourself

After we have an understanding of your goals, we will invite you to fill out a thorough application via our secure online portal. This application will cover your personal information, living history, income, assets, and liabilities.

Help us help you

Once you've submitted your application, a list of requested documents will be automatically generated based on your information. You can confidently upload your document to our secure portal. This is a crucial stage in the process to ensure we're armed with the right information to find you the best possible mortgage solution.

We can help you streamline your document collection process by reaching out to your accountant and/or financial advisor.

Let's review

With your documents in hand, our team will review your file as a whole. This is where we'll crunch the numbers to find the best solutions available for your situation. We'll invite you to set up a time to chat and review your options together.

You'll not only be provided with all the facts, but unbiased support as well.

Let's put your plan into action!

If you're house hunting, we will provide you and your REALTOR® with a pre-approval letter to strengthen your offers.

Otherwise, at this stage you will receive a breakdown of your conditional commitment suitable for your situation (e.g. refinance, equity take out, transfer, renewal), which we will discuss together in detail.

Streamers, balloons and keys.... oh my!

Once all conditions of your commitment have been satisfied, your solicitor will help to finalize your goal.

Our role doesn’t end here! We will be in touch annually to ensure you are on track with your goals. Expect regular updates and announcements from us as well. We want to ensure you’re kept in the loop with any changes that could impact you and your family. Have questions in the meantime? We are always free for a call or email.

CALCULATE

Whether you're just getting started, have a home in mind, or want to refinance or renew an existing mortgage, why not start by using our online calculator?

APPLY NOW

You've run some preliminary calculations and you've signed the consent form. The next step is to go through our online mortgage application.

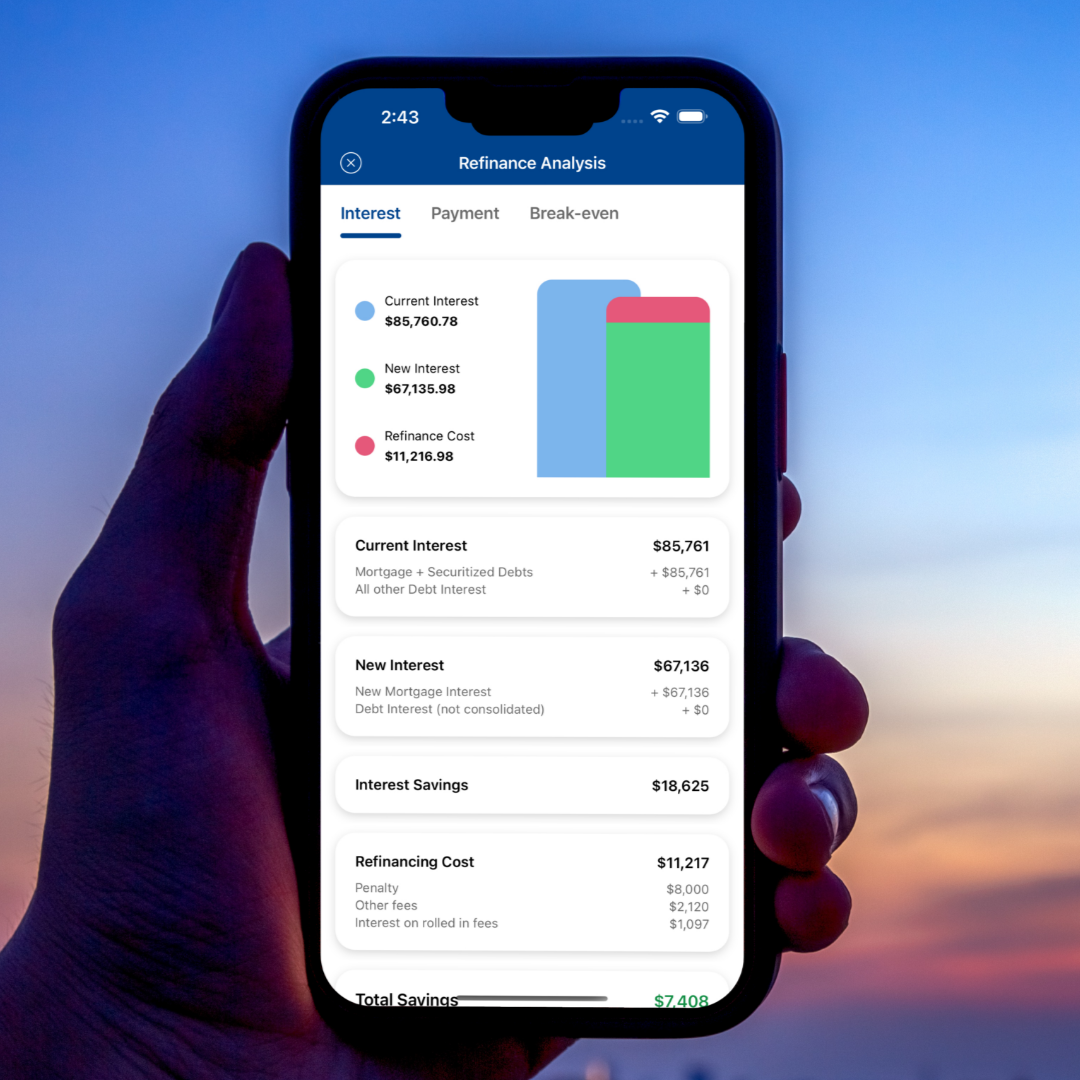

Download Our Calculation App

We have our very own Canadian Mortgage App. This award winning app was designed to help aspiring and current homeowners feel informed and prepared, as well as help guide their financial professionals (including us!) in finding the right solution.

Whether buying a house, refinancing an existing mortgage or confirming related expenses, you can use the app's innovative calculation tools to explore multiple scenarios and make more informed decisions.

Use the button below to learn more and download our FREE app today to experience the convenience of having all of your essential mortgage tools in one place!

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Slide title

Write your caption hereButton

Siya

Adam is professional, friendly, and he anticipated and answered any and all questions that we had. We wouldn't think of using anyone else in the future to deal with our mortgage other than Adam. It's just that simple -- Adam is the BEST! We are so pleased to call Adam Hawryluk our mortgage broker. Thanks, Adam!

Marty & Sonja

He was able to walk me through the process and was extremely helpful the entire time.

Thanks!

Rodney

Emily & Ben

Eileen

Nicole

Thank You for all your hard work!

Chris & Laura

Kara

Carmela

G & R

BOOK A CALL

Ready to chat? In order to best serve you, we like to start with a quick phone call to get an idea of how we can help!

Pauline Dawson

Mortgage Broker

Adam Hawryluk

Mortgage Broker

SEND A MESSAGE

Not ready to book a phone call? No worries, feel free to send us a message and we'll respond via email.

Contact Us

We will get back to you as soon as possible

Please try again later