BC Home Flipping Tax

If you are selling a BC property after January 1, 2025 and have owned the property for less than 2 years (730 days), then you may be required to pay the new BC Home Flipping Tax. Completely separate from the federal property flipping rule, this tax is collected by the BC Provincial Government and applies to all sellers of taxable BC property, no matter where the seller lives.

You must file a BC home flipping tax return within 90 days of the sale, if either of the following applies:

- Sold your property within 90 days of purchasing it and are not eligible for any exemptions

- Your exemption applies only after you file a return.

QUICK FACTS

- Tax applies to the net taxable income from a sale of a taxable BC property

- Effective January 1, 2025 (applies to any sales completed henceforth)

- Seller must own the property for less than 730 days

- Seller does not have to be a BC resident (may reside anywhere in the world)

- Tax is separate from the Federal Property Flipping Rule

- Applies to residentially zoned property or the right to acquire such property

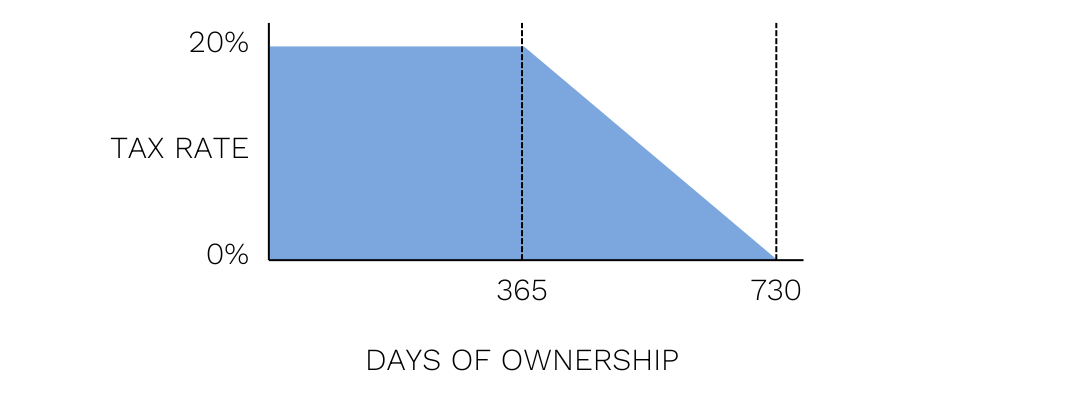

- Tax rate is 20% until after 365 days of ownership, then the rate will decrease until 0% at 730 days.

- There are various exemptions to the tax

TAXABLE PROPERTIES

- Properties with a housing unit

- Properties zoned for residential use

- The right to acquire the above properties, such as pre-sale contracts (see more HERE)

- The tax will not apply to exempt property locations or the leasing or sale of a leasehold interest in a property.

SEE MORE INFORMATION ON TAXABLE PROPERTIES

TAX CALCULATION

The tax rate is 20% of net taxable income earned from a property sold within 365 days, and the rate decreases over the next 365 days, until 730 days, where the tax no longer applies

SEE MORE INFORMATION ON TAX CALCULATION

TAX EXEMPTIONS

There are various exemptions from this tax including:

SEE MORE INFORMATION ON TAX EXEMPTIONS

OAC, E&O

CONTACT US

VISIT US

#13 - 327 Prideaux Street

Nanaimo, BC V9R 2N4

All Rights Reserved | The Collective Mortgage Group | Verico Mortgage Broker Network | OAC, E&O | Privacy and Content Policy