Mortgage Penalties

What is a

Mortgage Penalty?

What do I need to know about breaking my mortgage?

WHY ARE MORTGAGES BROKEN?

To break a mortgage, is to change or terminate your mortgage contract before the end of your term. Many people have no intention of breaking their mortgage, but in reality more than half of Canadians do.

The reasons for this vary immensely and may include:

- to obtain a lower interest rate

- to move (upsizing/downsizing)

- to access equity (renovations, big purchases, etc.)

- to consolidate debts

- to remedy unexpected life events

*Not all mortgages can be broken without selling your home. Check with your lender!

By building a strategy around this, we can potentially save you tens of thousands of dollars.

WHAT IS A 'PENALTY'?

A penalty is incurred when a mortgage is broken before the end of your term. This is how the lender makes back some of the lost interest from the remainder of your term. The calculation for penalties is dependent on the original lender, mortgage product and rate type.

For variable rate mortgages, this penalty is calculated as:

- the sum of 3 months interest.

For fixed rate mortgages, this penalty is calculated as the greater of either

- the sum of 3 months interest; or

- an Interest Rate Differential (IRD) penalty

*There may be other fees associated with breaking your mortgage. Check with your lender!

WHY ARE MORTGAGES BROKEN?

To break a mortgage, is to change or terminate your mortgage contract before the end of your term. Many people have no intention of breaking their mortgage, but in reality more than half of Canadians do.

The reasons for this vary immensely and may include:

- to obtain a lower interest rate

- to move (upsizing/downsizing)

- to access equity (renovations, big purchases, etc.)

- to consolidate debts

- to remedy unexpected life events

*Not all mortgages can be broken without selling your home. Check with your lender!

By building a strategy around this, we can potentially save you tens of thousands of dollars.

WHAT IS A MORTGAGE PENALTY?

A penalty is incurred when a mortgage is broken before the end of your term. This is how the lender makes back some of the lost interest from the remainder of your term. The calculation for penalties is dependent on the original lender, mortgage product and rate type.

For variable rate mortgages, this penalty is calculated as:

- the sum of 3 months interest.

For fixed rate mortgages, this penalty is calculated as the greater of either

- the sum of 3 months interest; or

- an Interest Rate Differential (IRD) penalty

*There may be other fees associated with breaking your mortgage. Check with your lender!

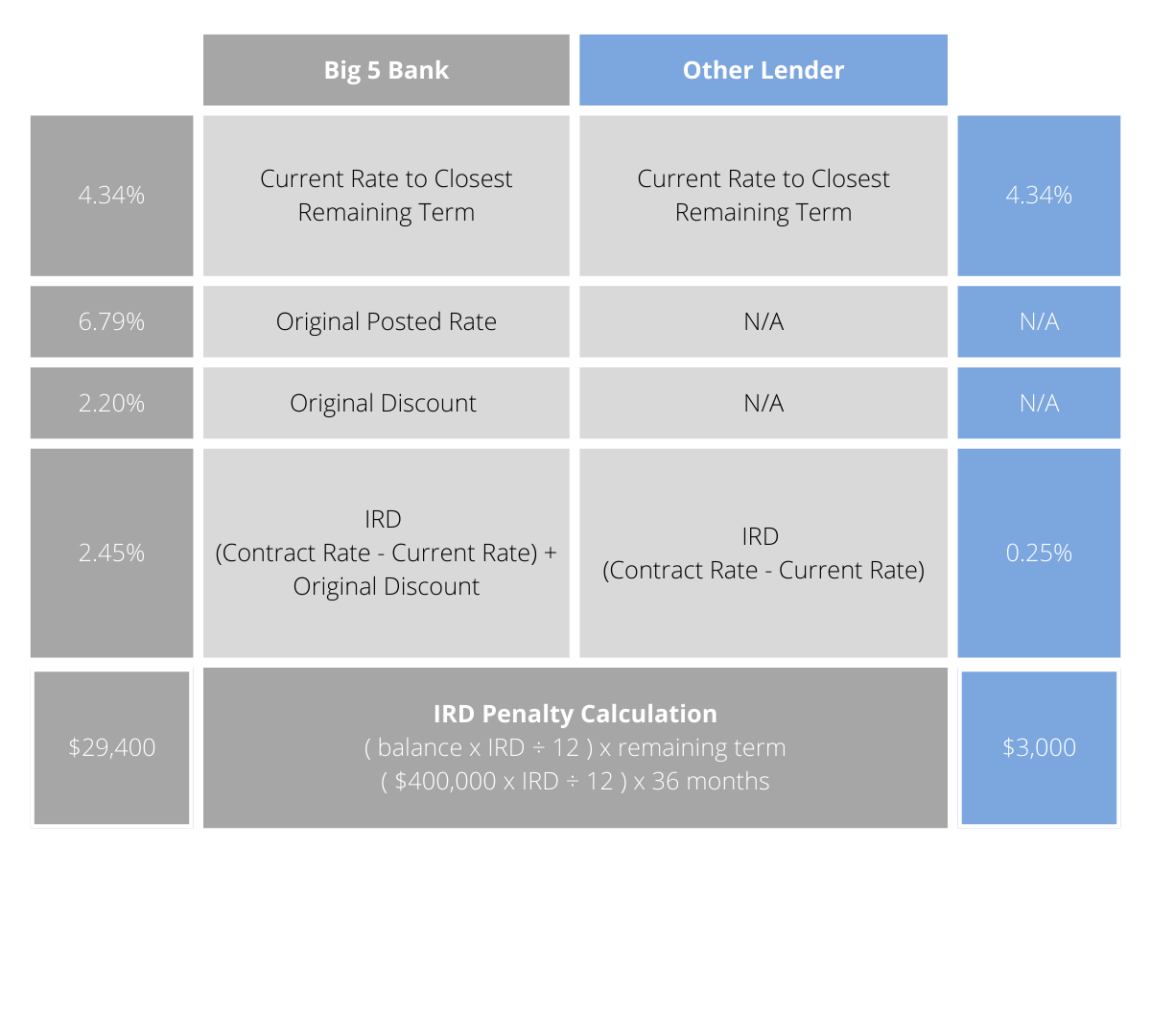

IRD PENALTY CALCULATIONS

How an IRD penalty is calculated varies between lenders, and the cost difference can be staggering!

Lenders like the Big 5 Banks offer discounts on their posted rates upfront. That “discount” can come back to haunt you, as it is used in the IRD penalty calculation. As a mortgage broker, we have access to other lenders where this is not a concern. No posted rates or discounts; what you see is what you get.

In this example calculation table, the original contract rate in both scenarios is 4.59%. At the time of breaking the mortgage the current balance is $400,000 with 3 years remaining.

The difference in IRD penalty calculations equals $26,400!

CONTACT US

VISIT US

#13 - 327 Prideaux Street

Nanaimo, BC V9R 2N4

All Rights Reserved | The Collective Mortgage Group | Verico Mortgage Broker Network | OAC, E&O | Privacy and Content Policy