Payment-Optional Mortgage

I'm tired of making my

Mortgage Payments

What is a

Payment-Optional Mortgage?

ONLY AVAILABLE TO HOMEOWNERS 55 YEARS AND OLDER

WHAT IS A PAYMENT-OPTIONAL MORTGAGE?

Just like a conventional mortgage, this loan is secured against the value of your home, with the difference being that the mortgage payments are optional. If you choose not to make payments, the interest that accumulates is added to your mortgage balance (this will never exceed your home's value).

You can opt for a lump sum to pay off debts, prepare for any large upcoming purchases/expenses, or simply give yourself a buffer for retirement. In addition, you can choose to take monthly advances to help supplement your income. Interest will only accumulate on the funds advanced at that point in time. If you have an existing mortgage or home equity line of credit, this will be paid out with the new mortgage funds.

This type of mortgage, also known as a reverse mortgage, allows you to access equity while staying in your home and community, without having to sell/downsize.

OUR PROMISE

We understand this can be overwhelming. Our top priority is to help address your concerns and answer your questions.

We promise to always:

✓ Listen carefully

✓ Speak clearly and offer useful information

✓ Respect you and your privacy

✓ Never apply pressure

WHAT DOES THE PROCESS LOOK LIKE?

1️⃣ Discuss your options & needs

We will sit down together to chat through what makes sense for you and answer any questions you may have.

2️⃣ Confirm your home's value

The lender will order an appraisal on your behalf to confirm the value of your home and determine how much you can access.

3️⃣ Review your commitment

We will review this together and assist you with the paperwork.

4️⃣ Obtain legal advice

We can help arrange an appointment with one of our trusted partners, or you are welcome to use your own lawyer.

FREQUENTLY ASKED QUESTIONS

Will the bank own my home?

No, you maintain title and ownership of your home. Keeping your property taxes and home insurance in good standing and maintaining your property is all that is required.

Will my government benefits be affected?

No, any government benefits you receive like OAS and CPP will not be affected by your reverse mortgage.

Are the funds received from my reverse mortgage taxable?

No, the lump sum and/or monthly advances you receive from your reverse mortgage are non-taxable.

If one spouse passes, does the remaining spouse have to pay the balance?

No, if one spouse passes away, the other may remain in the home without having to make a repayment unless they decide to move or sell.

Can my mortgage balance ever exceed the value of my home?

No, your mortgage balance will never exceed the fair market value of your home. The vast majority of borrowers will have substantial remaining equity from their home after repaying their reverse mortgage.

How much equity can I access?

You can access up to 55% of the appraised value of your home, depending on your age, location, and type of home.

How much will my monthly payments be?

Payments are optional. If you choose not to make payments, the accrued interest is added to your balance, which is repaid when you move or sell.

How much are the closing costs?

Closing costs will include the legal fees of $1,795 - $2,495 and an estimated $500 - $900 for independent legal advice (this varies depending on your lawyer). Both of these costs will be deducted from the mortgage proceeds. The appraisal cost may need to be paid in advance (approx. $500).

What documents will I need to provide?

You will be asked to provide 2 pieces of ID, a copy of your current home insurance policy, your most recent property tax statement (with proof of payment or deferral), a void cheque, and a current mortgage/HELOC statement (if applicable).

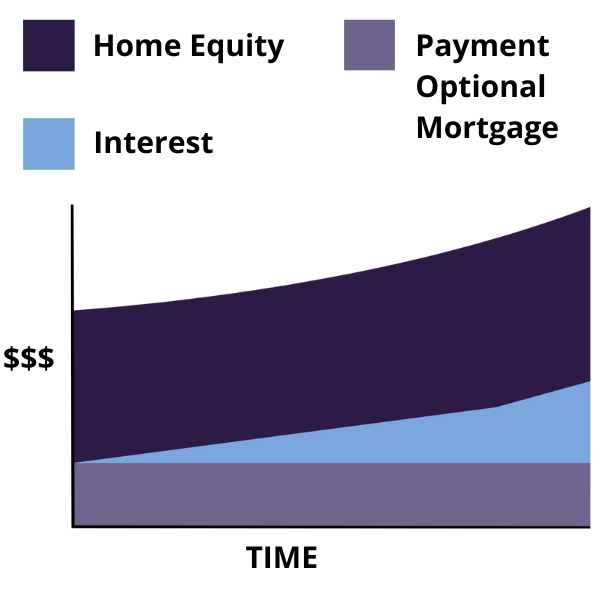

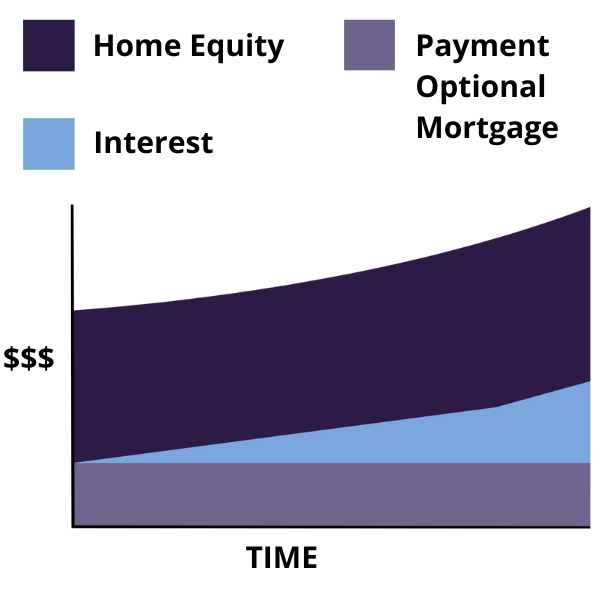

EXAMPLE ILLUSTRATION

We will provide you with a customized report specific to your individual situation.

WHAT IS A PAYMENT-OPTIONAL MORTGAGE?

Just like a conventional mortgage, this loan is secured against the value of your home, with the difference being that the mortgage payments are optional. If you choose not to make payments, the interest that accumulates is added to your mortgage balance (this will never exceed your home's value).

You can opt for a lump sum to pay off debts, prepare for any large upcoming purchases/expenses, or simply give yourself a buffer for retirement. In addition, you can choose to take monthly advances to help supplement your income. Interest will only accumulate on the funds advanced at that point in time. If you have an existing mortgage or home equity line of credit, this will be paid out with the new mortgage funds.

This type of mortgage, also known as a reverse mortgage, allows you to access equity while staying in your home and community, without having to sell/downsize.

OUR PROMISE

We understand this can be overwhelming. Our top priority is to help address your concerns and answer your questions.

We promise to always:

✓ Listen carefully

✓ Speak clearly and offer useful information

✓ Respect you and your privacy

✓ Never apply pressure

WHAT DOES THE PROCESS LOOK LIKE?

1️⃣ Discuss your options & needs

We will sit down together to chat through what makes sense for you and answer any questions you may have.

2️⃣ Confirm your home's value

The lender will order an appraisal on your behalf to confirm the value of your home and determine how much you can access.

3️⃣ Review your commitment

We will review this together and assist you with the paperwork.

4️⃣ Obtain legal advice

We can help arrange an appointment with one of our trusted partners, or you are welcome to use your own lawyer.

EXAMPLE ILLUSTRATION

We will provide you with a customized report specific to your individual situation.

FREQUENTLY ASKED QUESTIONS

Will the bank own my home?

No, you maintain title and ownership of your home. Keeping your property taxes and home insurance in good standing and maintaining your property is all that is required.

Will my government benefits be affected?

No, any government benefits you receive like OAS and CPP will not be affected by your reverse mortgage.

Are the funds received from my reverse mortgage taxable?

No, the lump sum and/or monthly advances you receive from your reverse mortgage are non-taxable.

If one spouse passes, does the remaining spouse have to pay the balance?

No, if one spouse passes away, the other may remain in the home without having to make a repayment unless they decide to move or sell.

Can my mortgage balance ever exceed the value of my home?

No, your mortgage balance will never exceed the fair market value of your home. The vast majority of borrowers will have substantial remaining equity from their home after repaying their reverse mortgage.

How much equity can I access?

You can access up to 55% of the appraised value of your home, depending on your age, location, and type of home.

How much will my monthly payments be?

Payments are optional. If you choose not to make payments, the accrued interest is added to your balance, which is repaid when you move or sell.

How much are the closing costs?

Closing costs will include the legal fees of $1,795 - $2,495 and an estimated $500 - $900 for independent legal advice (this varies depending on your lawyer). Both of these costs will be deducted from the mortgage proceeds. The appraisal cost may need to be paid in advance (approx. $500).

What documents will I need to provide?

You will be asked to provide 2 pieces of ID, a copy of your current home insurance policy, your most recent property tax statement (with proof of payment or deferral), a void cheque, and a current mortgage/HELOC statement (if applicable).

CONTACT US

VISIT US

#13 - 327 Prideaux Street

Nanaimo, BC V9R 2N4

All Rights Reserved | The Collective Mortgage Group | Verico Mortgage Broker Network | OAC, E&O | Privacy and Content Policy